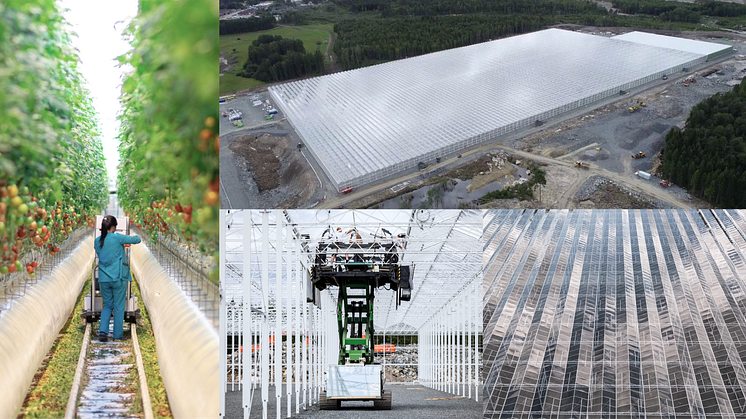

Vinga gratulerar Patriam Invest till refinansieringen och emissionen av gröna obligationer om 780 miljoner kronor

Med nya projekt identifierade, ett strategiskt beslut om expansion och en organisation bemannad för tillväxtplanerna, avser Patriam att ha en förvärvstakt på cirka två projekt om året framöver. För att möjliggöra ambitionerna emitterar bolaget gröna obligationer om cirka 780 miljoner kronor inom ett ramverk om 1,5 miljarder kronor.