Pressmeddelande -

Vinga acted as advisor in connection with the EUR 25 million secured fixed-rate bond issue for Regenergy Frövi AB

Regenergy Frövi AB, the project owner of a large-scale development of an innovative greenhouse facility, successfully closed a EUR 25 million secured fixed-rate corporate bond. This transaction is a partial closing of the Issuer's framework of up to EUR 70 million, and the capital raising will continue with several tap issues.

The bond issue was well received by the market, demonstrating the project's relevance and timeliness in the context of necessary decisive environmental actions in the form of industrial-scale solutions.

Vinga acted as advisor in the transaction, and Roschier Advokatbyrå AB acted as Corporate Finance Legal Advisor. The bonds will be registered through Euroclear Sweden.

Contact:

Johan Bergström

Senior Project Manager – Vinga Corporate Finance

+46 720 80 30 03

jb@vingacorp.se

About Regenergy Frövi

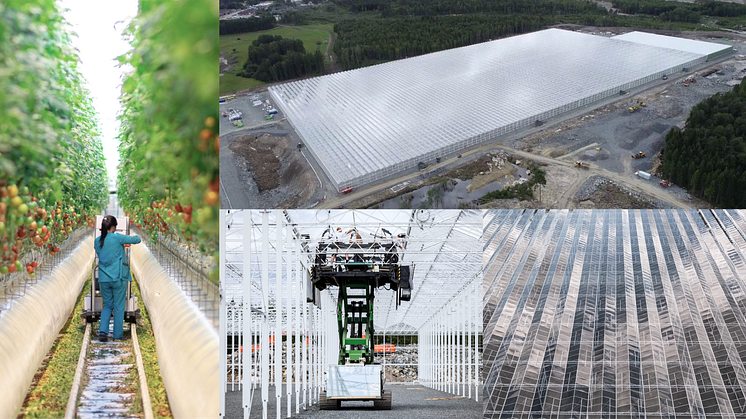

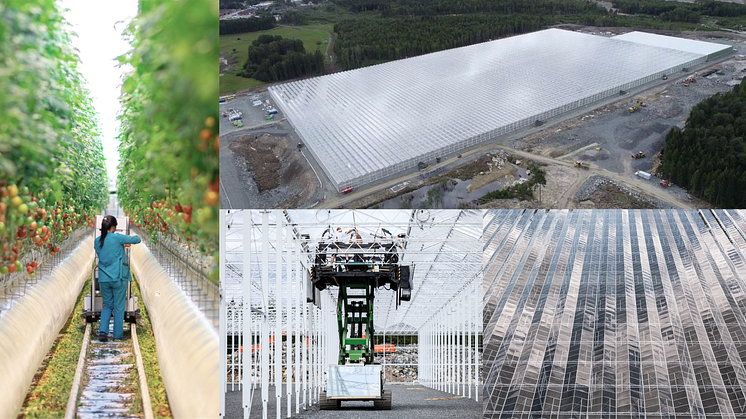

Regenergy Frövi AB, owned and funded by WA3RM Regenergy Developer Fund 1 AB, is developing a 217,000 sqm greenhouse facility for tomato production using low-tempered waste heat from a closely located papermill owned and operated by Billerud. The greenhouse facility is expected to produce an annual tomato production of 18,500 tons.