Pressmeddelande -

Goldman Sachs refinances bonds in Regenergy Frövi AB

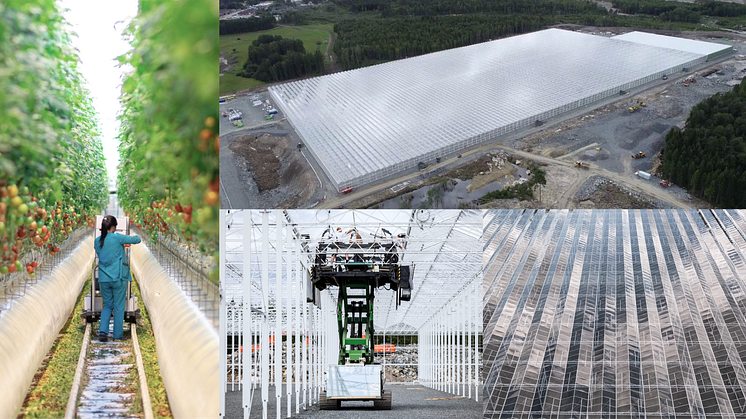

Regenergy Frövi AB utilizes industrial waste heat and green electricity to produce vegetables in the largest greenhouse in the Nordics. Since 2023, Vinga Group has structured and raised approx. SEK 600 million in green bond financing and direct lending for Regenergy Frövi, contributing to the construction and development of the landmark project. When operating at full capacity, the production will account for one in every five tomatoes consumed in Sweden. On Tuesday, Regenergy Frövi announced a EUR 89 million debt investment and refinancing from Goldman Sachs Alternatives.

Regenergy Frövi repurposes industrial waste heat from a nearby paper mill to produce vegetables year-round in a groundbreaking 100,000 m² greenhouse. The project, developed by WA3RM AB, supplies sustainable tomatoes, increases circularity, and creates hundreds of local jobs. In August 2024, the first batch of locally produced tomatoes was harvested and distributed to ICA and Coop supermarkets across Sweden, representing a key milestone and proof of concept for the company.

Since 2023, Vinga Group has structured and raised approx. SEK 600 million in green bond financing and direct lending for the Regenergy Frövi project. The bond issue has generated significant market interest, demonstrating the project's relevance and timeliness in the context of combating climate change and the increasing need for self-sufficiency. The announced EUR 89 million investment from Goldman Sachs Alternatives secures long-term financing for Regenergy Frövi and will fund the construction of a second greenhouse of similar size.

"Regenergy Frövi represents an exciting new chapter in Swedish industrial history. We are proud to have advised the company and to have structured sustainable financing that has proven crucial to the project's realization. This refinancing, from a highly sophisticated investor such as Goldman Sachs Alternatives, is a testament to the quality of the project and the transformative business model”, says Tom Olander, CEO of Vinga Group.

“The green bond issue for Regenergy Frövi was well received by the market and has generated competitive investor returns. This project is a prime example of an innovative business model that simultaneously generates sustainable food, local jobs and increased self-sufficiency on a national level. Industrial-scale circularity is here to stay, and we look forward to helping realize similar projects in the future”, says Johan Bergström, Head of DCM at Vinga Corporate Finance.

"The project in Frövi is only the beginning of what we strongly believe will change how future industrial development is designed and financed. We are disrupting the traditional approach with linear concepts, by putting unused resources to the best possible use. Circular concepts, where we share and optimize resources, is the future”,says Jacques Ejlerskov, CEO of WA3RM.

About Goldman Sachs Alternatives

Goldman Sachs (NYSE: GS) is one of the leading investors in alternatives globally, with over $500 billion in assets and more than 30 years of experience. The business invests in the full spectrum of alternatives including private equity, growth equity, private credit, real estate, infrastructure, hedge funds and sustainability. Clients access these solutions through direct strategies, customized partnerships, and open-architecture programs.

The business is driven by a focus on partnership and shared success with its clients, seeking to deliver long-term investment performance drawing on its global network and deep expertise across industries and markets.

About Vinga Group

Vinga Group offers a wide range of financial services within corporate finance, investment advisory, and asset management. Through international reach and placing power, Vinga provides investors and growth companies with access to the Nordic capital markets. With over 200 transactions and SEK 20 billion in raised capital, Vinga is a leading provider of bond financing for Nordic growth companies.

About WA3RM

WA3RM is a global leader in developing circular operations on an industrial scale for recycling waste streams. By utilizing waste heat from energy-intensive industrial production, WA3RM has developed a circular model enabling profitable vegetable cultivation in colder climates. Vegetable production in modern greenhouses using waste heat addresses many of the challenges in today’s global food production, such as water scarcity and emissions from fossil fuel heating.

For more information, please contact:

Tom Olander, CEO of Vinga Group

+46 (0) 706 83 75 31

to@vingagroup.com

Johan Bergström, Head of DCM, Vinga Corporate Finance

+46 (0) 720 80 30 03

jb@vingacorp.se